Biography

Main responsibilities

Doris is responsible for the submission of proxy vote instructions, ensuring effective and robust voting on over 4000 companies annually in line with our Corporate Governance and Corporate Responsibility Voting Policy. This includes ensuring the in-house database is updated with all voting events, vote decisions, correspondence/conversations with companies and other key information for the purpose of audit keeping and client reporting. She is also responsible for the maintenance of the ethical screens and managing custodian relationships. Doris was responsible for designing and the maintenance and distribution of the Heatmap (Aviva Investor’s key ESG integration tool). She reports to the Head of Corporate Governance

Experience and qualifications

Prior to joining Aviva Investors, Doris worked as a consultant at DF King where she advised clients on investor relations and proxy solicitation. Doris holds a BA (Hons) in Business Information Systems from the University of Lincolnshire.

Related profiles

Agneta Bamania

Senior Analyst, Sustainable Investments

Nick Molho

Head of Climate Policy

Riona Bowhay

Senior Macro Stewardship Analyst

Greta Talbot-Jones

Director, Responsible Investment

Louise Wihlborn

Senior Strategist – Stewardship

Giulia Bertuzzi

Junior Portfolio Manager, Liquid Markets

Vaidehee Sachdev

Social Stewardship Lead

Thomas Tayler

Head of Climate Finance

Sora Utzinger

Head of ESG Corporate Research

Steve Waygood

Chief Sustainable Finance Officer

Richard Butters

Head of Stewardship

Louise Piffaut

Head of ESG, Public Markets

Eugenie Mathieu

Nature Stewardship Lead

Abigail Herron

Global Head of Health and Nature Policy

Mirza Baig

Chief Sustainable Investing Officer

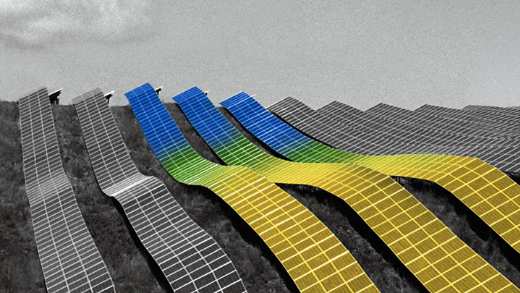

This is what climate action looks like

We're on a mission to rewrite the future of investing and create a climate of change.

It takes Aviva Investors.

You might also be interested in

-

Boosting low-carbon investment in the UK: A Policy Roadmap

16 Jul 2024

Our in-depth Roadmap for the UK’s journey towards a low-carbon economy contains policy recommendations to unlock private investment in the transition.

-

The future of green premia in real estate, part two: Searching for value and resilience

8 Jul 2024

Do energy-efficient buildings have more pricing power, and what could that mean for those investing in the built environment? We bring together the views of leading capital markets researchers, a valuer and an asset manager for the second part of our deep dive into green premia, analysing the investment implications.

-

Avoid, reduce, remove, align: Finding climate transition investment opportunities in real assets

3 Jul 2024

In this article, Luke Layfield and Zoe Austin explain four key pillars that can help real asset investors align their strategies with the climate transition and uncover opportunities to deliver attractive returns.

-

The future of green premia in real estate, part one: The view from the ground

27 Jun 2024

Do greener buildings have more pricing power, and if so, how much? We bring together the views of leading capital markets researchers, a valuer and an asset manager for a two-part deep dive on the latest market dynamics.

-

Blueprints for a greener economy: Creating a transition planning ecosystem

25 Jun 2024

National transition plans can give investors support, confidence and direction to accelerate the flow of finance to bring about a low-carbon economy. As such, they should be seen as a strategic opportunity.

-

Nothing to fear: Sustainable investing trade-offs

19 Jun 2024

Sustainable investing, and the supposed trade-offs involved, have been a topic of heated debate. But trade-offs are a fundamental part of all types of investment; the key is to be clear about your objectives, as Mirza Baig explains.

-

See the wood, not just the trees: How climate-focused credit investors can help drive real-world change

14 May 2024

Green bond funds and Paris-aligned benchmarks are aimed at climate-focused credit investors who also want the simplicity of passive investing. But while they decarbonise portfolios, they exclude the companies in the real economy that need to transition if the world is to meet the Paris Agreement goals. This is why an active approach can be beneficial.

-

Building better: Opportunities for DC schemes to invest in the climate transition through real assets

22 Mar 2024

By investing in climate-aligned real assets, defined-contribution pension schemes can help propel the transition while also benefiting from portfolio diversification and attractive risk-adjusted returns, says Mark Meiklejon.

-

The war on bugs: Climate change contributes to growth in the pest-control industry

13 Mar 2024

Pest control has become a growing priority for city residents and authorities all year round, as rising temperatures and other factors boost the populations of many pest species. But in creating adaptation solutions, the sector could also represent a long-term investment opportunity.

-

Credit spreads and climate solutions: The outlook for climate-focused bond investors

8 Feb 2024

For the first time in three years, interest rates should no longer be a headwind for credit markets in 2024, but other forms of uncertainty may affect climate-aware bond investors. Our credit experts discuss the key themes they expect to play out over the coming months.

-

Common ground: Earning a social licence to operate in real asset investing

18 Jan 2024

Successful real asset investing requires acceptance of asset managers’ practices and procedures from a variety of stakeholders. We explore what this means for managers, their clients and investment outcomes.

-

Plus ça change…The outlook for infrastructure debt in 2024

11 Jan 2024

Infrastructure demonstrated characteristic resilience in 2023 in the face of significant macroeconomic headwinds. Darryl Murphy from our infrastructure team explains why he expects current themes to persist in 2024.

-

Tech, trees and tailwinds: The outlook for climate transition real assets

9 Jan 2024

In this Q&A, James Tarry and Luke Layfield explore the themes shaping the landscape for real asset investors with a climate transition focus.

-

Changing course: Creating a stable investment framework for offshore wind

30 Nov 2023

Better market mechanisms and grid connection arrangements are essential to restore a stable investment environment in the offshore wind sector, as Nick Molho explains.

-

The tipping point for climate finance: Making financial flows consistent with the Paris Agreement

29 Nov 2023

Transition plans, including from governments in response to the Global Stocktake, will be crucial to bring about the shift to a low-emissions, climate-resilient world. Markets need clear implementation signals to align capital with the goals of the Paris Agreement. Our in-depth report calls for the creation of a transition-plan ecosystem connecting all levels of the global economy.

-

The time to lead: Reforming multilateral development banks through a climate lens

28 Nov 2023

To have a chance of limiting global warming to less than two degrees, the world must unlock huge investments in emerging markets. This is prompting calls for the reform of multilateral development banks, but will this be enough?